On Thursday March 11, guest Speaker, Ellen Carney, Principal Analyst of Forrester Research joined Origami’s Scott Plummer, Market Strategy Lead - Claims Administration, for a look into the changing landscape of claims management and how Origami’s Claims Administration solution can help address some of those new demands.

Scott kicked off the discussion with a brief overview about Origami Risk. Founded in 2009 and built as a cloud-based platform in Amazon Web Services (AWS), Origami has since grown to over 330 employees and 600 risk and insurance clients across the globe with more than 1 million system users managing or adjudicating over 70 million claims.

Origami originated as a RMIS platform, evolved to a system that can also administer claims to where it is today as a system that can now also administer policies and handle billing.

Ellen went through Forrester’s perspective focusing on three main themes.

- How risk is changing and what that means for claims

- Why it's time to look at the claim through four different lenses depending on the different roles

- What it takes to deliver now on the claim experience

Changing Risks

COVID-19 had a huge impact on the business of insurance and the business of servicing customers when it came to claims.

What are the hazards that we’re dealing with? What are the potential things that could happen to us? Risk when it comes to insurance overall, is a little bit different and boils down to understanding the probability or the likelihood of one of those things actually happening. And of course that drives how Insurers underwrite policies and treat claims. The landscape is changing and it's changing fast. The likelihood of those perils are in fact increasing.

Some of the ways risk is changing are:

- Extreme weather is having an impact on the degree and severity of CAT events. (e.g. a January tornado here in the U.S. was well outside its mid-year season; rapid intensification is an interesting trend happening with hurricanes that we witnessed in Louisiana and other parts of the Gulf Coast).

- The Workplace and the changing workforce saw a large impact from COVID-19 and how Insurers interact with customers. It’s also changing for the customers that are being insured. For example, healthcare providers saw a major impact on medical care staff throughout the span of the pandemic. The workforce is changing substitution from direct employees to contractors, which has big implications on how work gets done and how we protect our businesses from workplace incidents. The nature of the workforce is also changing. The average age of the American worker has moved from 30 to 42, and older workers have different kinds of injuries.

- Technology and cyber - It wasn’t long ago we were using floppy disks. Now things are very different which is opening up new risks. Think about cyber, ransomware, and deep fakes.

- Drugs, both licit and illicit - A number of U.S. states have liberalized their drug laws to allow medical marijuana and recreational marijuana distribution. If this is legal in your state, how do you make sure your employees are not under the influence. This has changed background checks in a significant way. When it comes to illicit drugs, there are challenges with over-prescription opioid based medications. There has also been an increase in overdoses and deaths from overdoses in the workplace.

- Social and civil unrest and business interruption - There has been an uptick in social unrest in cities across the country. This has significant implications for business interruption coverage, vandalism.

- One last risk we don’t talk about enough is complacency. Now is not the time to get complacent about the risks insurers are facing and the claims experience they are delivering to their claimants, to the employers that are being covered, and to the ecosystem partners that help injured workers or people who have suffered losses return their way back to normal.

Ellen noted that Insurers are not only insuring these risks, but they are also living them as they may potentially impact their own organizations. Primary concerns were ranked with data privacy with the highest percentage followed by information security, strategic (are we making the right bets?), talent and human capital (our workforce is aging and it’s really aging in insurance), geopolitical, and climate.*

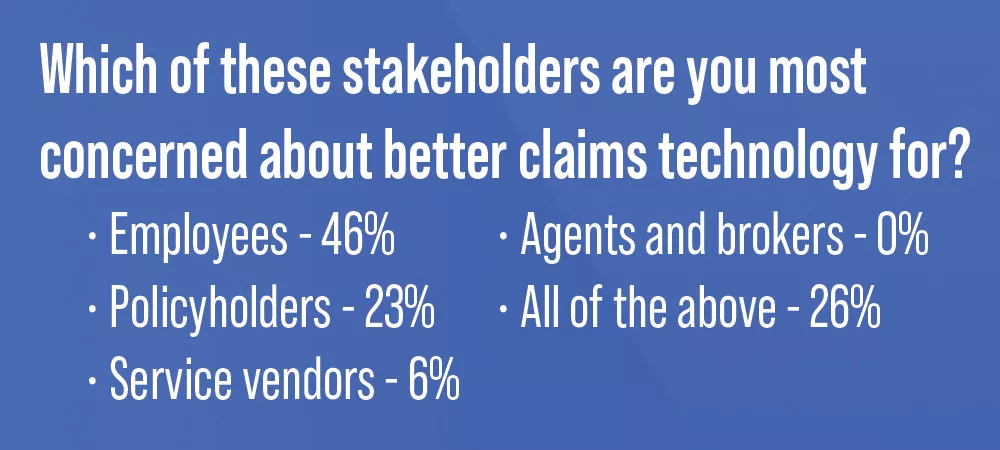

Connecting back to the poll results, all of these risks that insurers are facing are shaping the way companies are investing in claims technology. It’s the same thing we are seeing in Forrester surveys.

- Make things easier for employees. Give them a better experience and enable them with data and analytics to help them make the right decision about a claim. It’s going to drive higher customer satisfaction around the claims experience.

- Emerging technologies like AI have been an area of incredible interest, especially because of COVID-19. How can we improve our existing internal processes around claims management? How do we do more straight-through processing of claims? This is where we’re seeing AI capabilities get injected.

Takeaway:

Insurers can offer new technology, risks, and forms of coverage and more to their customers. Customers are also changing in terms of their expectations, as well as business partners. All of these things are going to have a big impact on the way the insurance industry handles claims and the question is, are their systems going to be able to handle those claims?

Historically we see insurance tech budgets increase 4% every year. In 2021, tech budgets will only be increasing about 1.5%. The takeaway being, spend your money wisely on the stuff that’s going to help you meet this changing market.

The Forrester Wave

As a result of all the change in the space, Forrester decided they needed to look at the claims experience in 2020 due to changing risks and from input through insurer inquiries that claims technology is getting stale.

Forrester defines P&C claims management as: A system of record that manages the life-cycle of a property or casualty insurance claim, from first notice of loss through to settlement of the loss with the claimant.

Ellen noted that it’s time for insurers to shift from managing policies to managing claims in the context of risks that are changing, that Forrester’s customers are facing, and that insurance organizations are grappling with. It has to become a priority for insurance organizations to move to how they blend this experience with the claim and how they manage risk in a more holistic way than has been done in the past.

Ellen shared insight on the The Forrester Wave™: P&C Claims Management Systems, Q4 2020 evaluation process. This report included P&C claims management vendors that are:

- Actively promoting, marketing, developing, and investing in their P&C claim management system capabilities to be part of this evaluation

- Generating at least $15 million directly attributable to its P&C claims management

- Supporting claims across multiple product lines

- Relevant to Forrester’s client base

Although Forrester’s criteria evolves over time, they weighed the vendor’s current offering 50% and strategy 50%. While they include details about market presence, that didn’t factor into the overall rating.

We believe Forrester ranked Origami as a Strong Performer based on the following differentiators:

- Its approach to P&C claims management capitalizes on the company’s strength as a RMIS developer -- a really unique position to be able to pull that capability into handling claims.

- Offers a great product vision to use AI to free-up humans to help claimants and help deliver a better employee experience freeing them up from rekeying data.

- Origami’s Cloud-only delivery strategy avoids future migration challenges. Cloud is going to be the go-to. [Origami’s customer references brought up how] being on-prem really locks a carrier or pool into fairly limited capabilities at a time when things are changing quickly [vs. their cloud experience with Origami]

- Reference customers describe leadership and the service organization as flexible

- Ability to manage and collaborate around large, complex losses.

- Embedded self-help tools that get adjusters productive faster.

- Role-based collaboration portals for agents and vendors such as legal

- A dashboard UX features that ease the adjustor’s change from old systems to new.

Origami’s Prescription

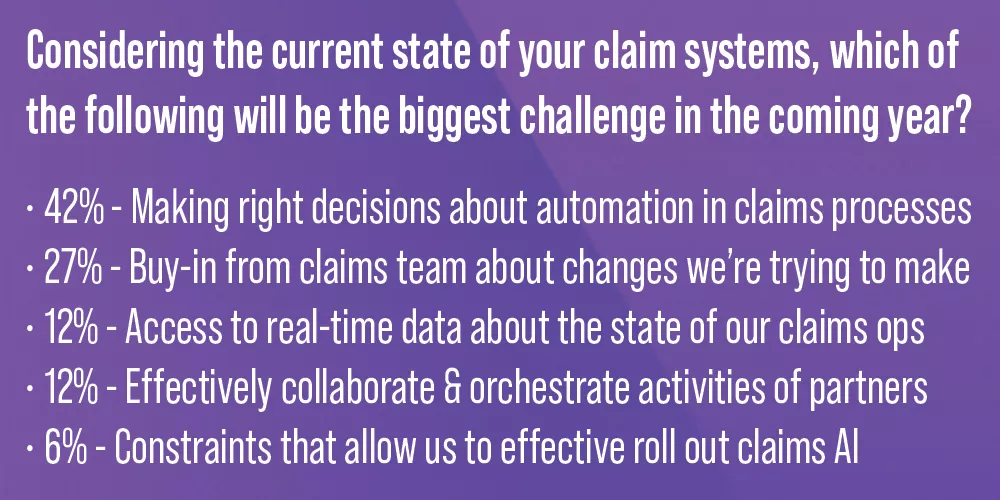

Scott noted the claims management challenges Ellen brought to life in her presentation:

- Changing risks

- Rising expectations from staff, agents, and policyholders

- New competitors and increased investment

He followed by sharing Origami’s prescription for claims management. It’s critical to utilize a platform that serves and guides all stakeholders - whether that be internal staff or external parties such as policyholders, agents/brokers and vendors. It should also adapt to new challenges without needing to schedule a lengthy IT project. Finally, it should be future-proofed and ensure you don’t get stuck needing to invest your limited budget in tactical technical upgrades by using a cloud-based technology like Origami.

In summary new risks are emerging, your stakeholders have higher expectations, and it’s a competitive race to best determine how to leverage new technologies.

Forrester’s Prescription

To close out the presentation Ellen shared what Forrester’s prescription for claims management would be.

- Build for the future - Things are changing really fast and if you are on-prem you are not going to be able to change fast enough. Products are changing, customer expectations are changing, competitors are changing. You have to have a system that will be able to support that.

- Be agile - You have to move quickly. It doesn’t mean you aren’t building something that’s resilient. It means that you are going to be there for your customers. Always be mindful about what we are in the business for.

- Embody the ecosystem - We rely on a whole host of people that help return the customer back to normal. The future of connecting the ecosystem means they are collaborative, automated, and open.

- Value specialization - Specialization is a good thing to value as opposed to trying to be everything to everybody.

*Source Forrester Business Technographics Security Survey, 2020

**Source: The Forrester Wave™: P&C Claims Management Systems, Q4 2020