In this series, we share insights from a recent study* which seeks to understand the current state of core insurance systems and market sentiment for adopting SaaS-based models.

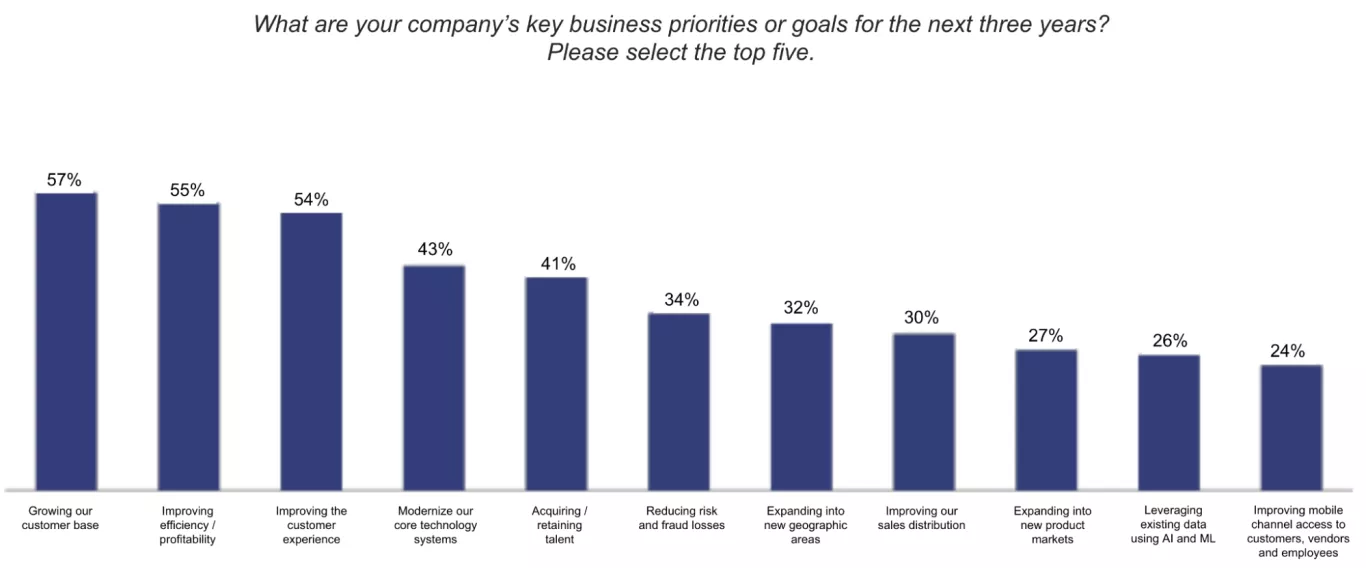

It’s common for organizations to have competing priorities given finite resources in terms of investment, talent, and time. To better understand how insurers are prioritizing their business goals over the next three years against these universally limiting factors, we surveyed them and asked them to rank their top five priorities.

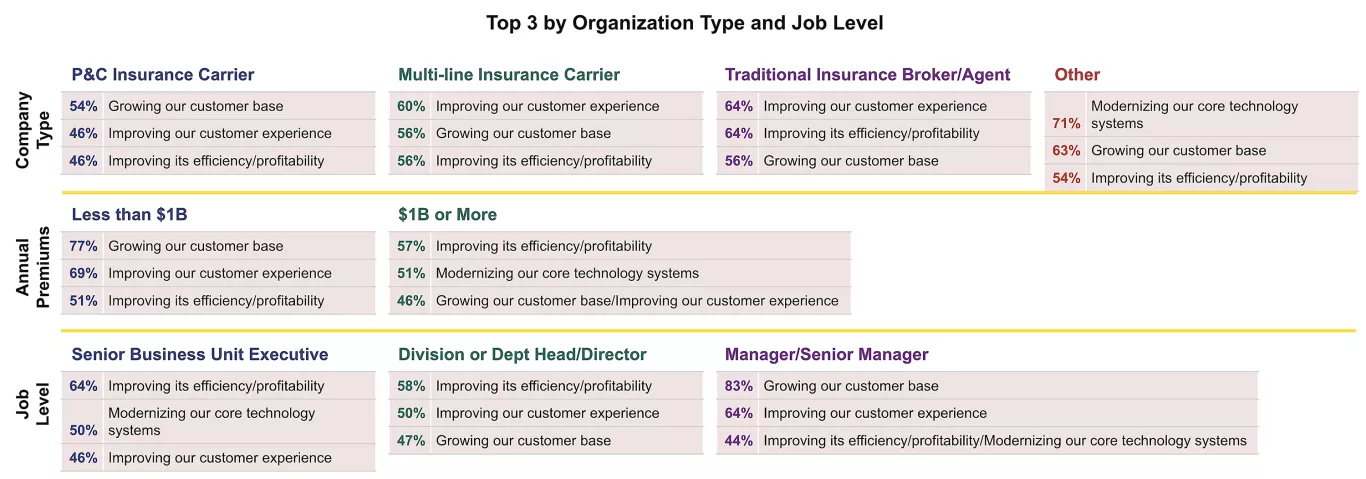

When the above responses were cross-referenced with the size of the organization, findings show that among insurers with annual premiums below one billion scored “Growing our customer base” and “Improving the customer experience” significantly higher than the average, at 77% and 69% respectively.

On the other hand, for insurers with annual premiums above one billion, modernizing core technology systems was cited as a priority by 51% of those in IT/technology roles.

Interestingly, leveraging existing data using AI and machine learning was cited more frequently by senior business unit executives (39%) compared to division or department directors (17%).

To further explore the variability in priorities across organizations, we analyzed the data based on job level, annual premium, and company type. While priorities were much more homogeneous at the company level, the results illustrate possible misalignment when it comes to implementing solutions at the job level.

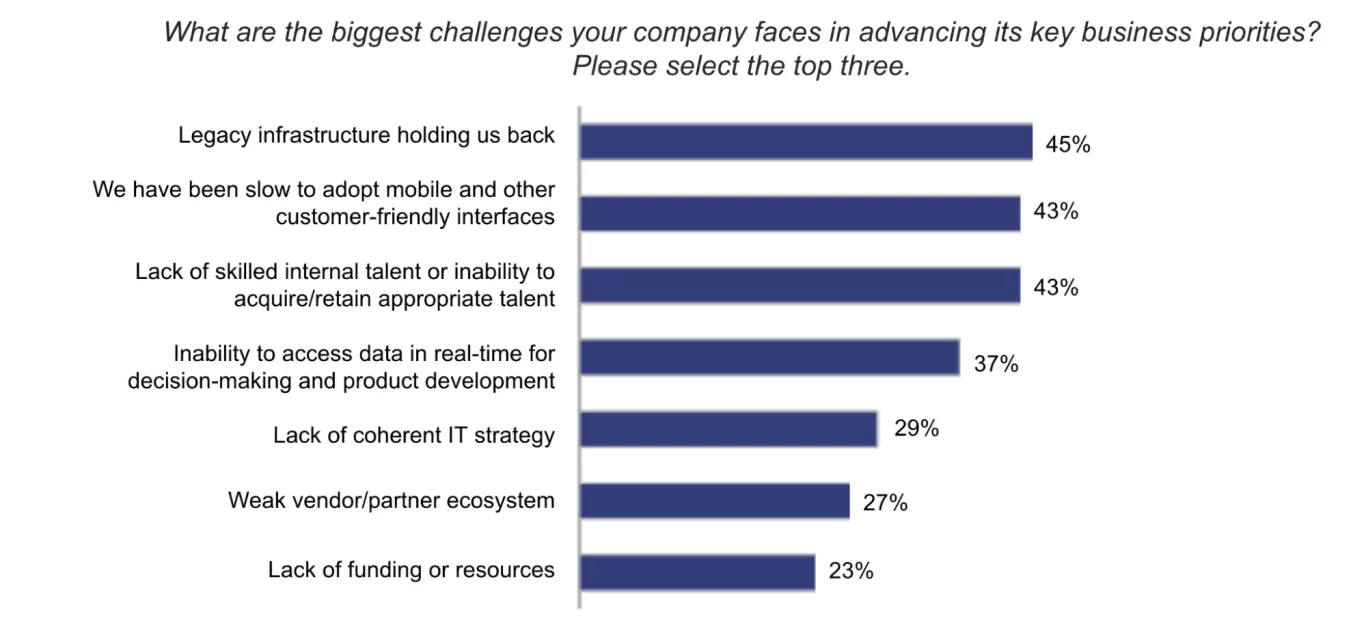

While modernization efforts didn’t make top priority across the board, legacy infrastructure and a lack of customer-friendly interfaces were the frontrunners when it came to the biggest challenges for advancing key priorities, far surpassing the lack of funding or resources.

The results are in line with the idea that short-term priorities are closely aligned with an organization's goals. However, they also highlight the fact that outdated infrastructure is a universal obstacle to growth, enhancing customer experience, and increasing efficiency. Insurance companies that successfully digitize their technology will be better positioned to achieve their top-line objectives and gain a competitive advantage.

To learn more about why the architecture matters in selecting core insurance cloud technology, download our eBook.

*Research Methodology and Respondent Profile

This research was commissioned by Origami Risk and conducted by Arizent/Digital Insurance between September 22 and October 20, 2022, among 100 qualified respondents. To qualify, insurance industry professionals had to have a management role (in a non-legal/HR function) and have knowledge of their organization’s core systems or primary supporting services.

Respondents self-identified as 51% P&C insurance carriers, 25% insurance broker/agent, 12% MGA/MGU, and 12% third-party administrators.

Total Respondents: n=100; Annual premiums under $1B: n=35/Annual premiums of $1B or more: n=65; IT/technology role: n=16; Primary core system is all or mostly on-premises: n=26; Senior business unit executive: n=28/Division or dept head/director: n=36.